Nov 10, 2015

5 Simple Tools Dentists Use to Better Understand Their Financial Statements

Written By: Brian Hanks

On Saturday my 8 year-old shattered my view that I’ve been a good dad. After a solid 10 minutes of watching college football next to me on the couch, he asked me, “Dad, what’s the score?”

The score? It’s been on the screen for 10 full minutes! Plain as day! How could he miss it?

Of course, after I thought about it, I realized that I’d never taught him how to read the scoreboard on the screen.

We spent the next few minutes talking about the four quarters. Which numbers meant points. Which numbers indicated time-outs left. I described the play clock and how that’s different from the game clock. Etc, etc.

It only took a few minutes, and now he gets it. Dad-of-the-year status firmly back in hand, I started thinking about you, dear dentist. You need to be able to read the score in your dental business. But you probably don’t. At least not very well.

You must know how to read your financial statements.

You must know if your financial statements are good or bad.

This post will tell you how to do both of those things. Let’s begin:

How to Read Your Dental Financial Statements

If I asked you, “How is business?” how would you respond?

Would you tell me how much your collections are this year?

Would you tell me how much cash is in the bank right now?

Both answers are wrong.

If you own your practice you run a business. The scorecard for your business are your financial statements. If you can’t read the scorecard, you don’t know the score.

And believe me – based on conversations I’ve had with hundreds of dentists, most of your colleagues can’t even read the scoreboard, let alone know the score.

You need to understand two key financial documents, and it’s easier than it sounds. 30 years ago Robert Follet wrote a book entitled “How To Keep Score In Business” (1987). He said that “a lot of people don’t understand keeping score in business. They get mixed up about profits, assets, cash flow and return on investment.”

If that’s you, don’t worry – it’s easier than it looks. You really only need to understand two documents:

- The Income Statement

- The Balance Sheet

The Income Statement

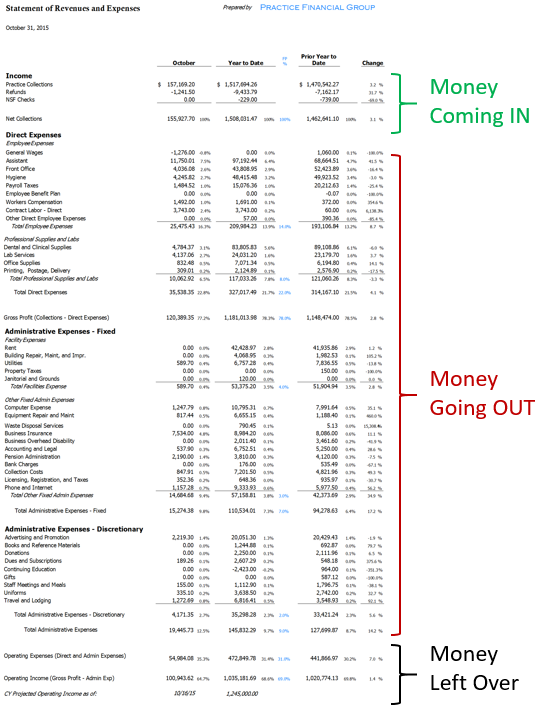

The income statement should be the most frequently used financial document in dental practices. Sometimes called the “Statement of Revenues and Expenses,” the Income Statement tells you three things:

- How much money is coming into the practice

- How much money the practice is spending

- How much is left over

That’s it. Usually the income (How much money is coming into the practice) is near the top of the page, followed by a longer list of expenses, categorized so that you can tell what the money was spent on, followed by a number that tells you how much is left over.

A quick word about the “leftovers” also known as “profit.” There are two kinds of profit, Operating Income and Net Income, and you should know the difference between the two.

Operating income is how much money is left over from the business, if you ignore everything directly related to the dentist him/herself. Operating income includes paying employees, paying utility bills, lab fees, dental supplies and all other normal business expenses with one key exception. What should be carved out is any money that goes to the dentist and his/her family. That includes the salary of the dentist and their family, and any perks like meals, auto expenses or health insurance on the dentist’s family only.

Net income is how much money is left in the business including any money that goes to the dentist. Net income is any money left over after any and all business related expenses have been accounted for.

The last vital component of the income statement you should understand is that it measures performance over a specific period of time. A typical income statement is usually measured over a calendar year. I also highly recommend that you look at a monthly view in addition to a full year.

The balance sheet

The second financial statement that is important for practice owners to understand is the balance sheet. The balance sheet tells you where the money for the business came from, and who owns the assets of the business.

The balance sheet contains three big pieces of information: assets, liabilities and what accountants call owner’s equity.

Assets are anything valuable that the business owns. In your practice, that’ll typically be cash in your bank account, your equipment, any supplies on the shelves, etc. Anything that you could sell to someone else.

Liabilities are money owed to someone else. In your practice, it’s your practice loan, equipment loans, etc. The liabilities tell you how much of the business is owned by someone other than the dentist.

Owner’s equity is how much of the business assets the dentist owns. Early in your practice, this number is probably small. Over time your owner’s equity should grow as you pay off debts.

A balance sheet doesn’t measure one specific time period. It is constantly updated for the life of the business.

Before I move on to showing you how to spot bad financial statements, let me pause to note that the knowledgeable accountant-types out there will object here that I’m leaving out a third financial document: the statement of cash flows. I’m going to leave that for another time, recognizing that for the average dental practice owner, it’s the least important of the three documents.

How often should you review your financial statements?

Now that you know what is in your income statement and your balance sheet, how often should you be reviewing them? The answer depends on how often you want to know the score.

I tell my clients that they should be reviewing their income statement once a month. I also tell them that they should review their balance sheet at least quarterly.

Reviewing the income statement monthly is crucial to monitor revenues and costs. You have to know how much money is coming in the door, and how much is going out. And you need to know that at least 12 times a year. Staying on top of this information allows you to make adjustments to the business, if needed. Maybe you need to focus more on selling your treatment plans? Maybe you need to negotiate a bit with your supply rep as costs are creeping up? You’ll never know unless you review the document at least monthly.

The balance sheet is okay to review less frequently. Not because the information is any less important, but because the information changes less frequently. Typically, you’re looking to note two key pieces of information: 1) am I paying down any debts like I planned, and 2) is my accountant aware of all accounts related to my business? You’ll be able to answer those questions by reviewing the balance sheet.

How to know if you have good or bad financial statements in your dental practice

Getting back to football, here’s an image from the 1972 playoff game between the Steelers and Raiders (this is the “immaculate reception”, for you football buffs out there). Check out the score on the screen:

Now compare that to an image from January 2015 (Oregon vs. Ohio State for the first College Football Championship, FYI). Check out how much more information is in the scoreboard on the screen!

You can see what quarter they’re in. You can see how much time is left, you can see the play clock, the down, how many yards to go. You can even see how many timeouts each team has, if you know what to look for.

It’s the same tool, but so much more useful. The same principle applies to your practice’s financial statements.

Do you have 1972 financials, or 2015 financials?

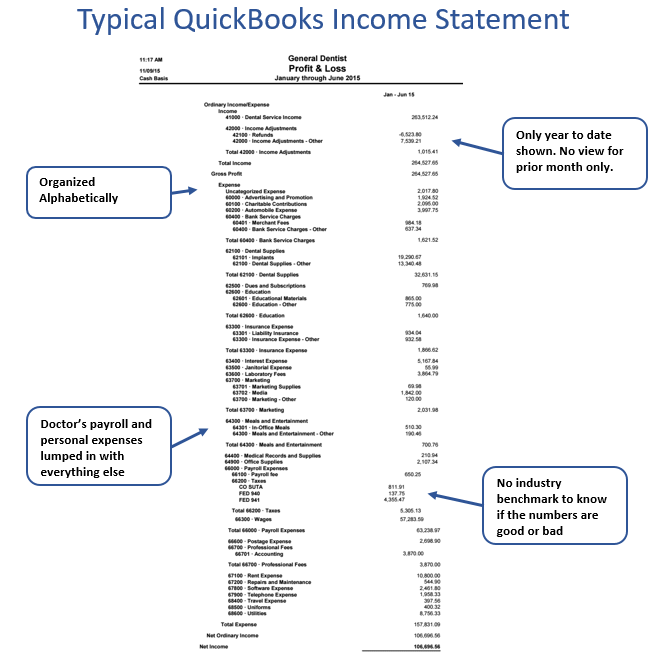

I hate to be the one to tell you this, but if you or your bookkeeper are using QuickBooks, your financial statements probably look a lot more like the picture from 1972.

I’m not anti-quickbooks. In fact, I think it’s a great tool for a lot of businesses. The problem I have with it is that it doesn’t provide the insight needed to run your business well out of the box. And the tweaking needed to get there is beyond most dentist’s and bookkeeper’s skill set.

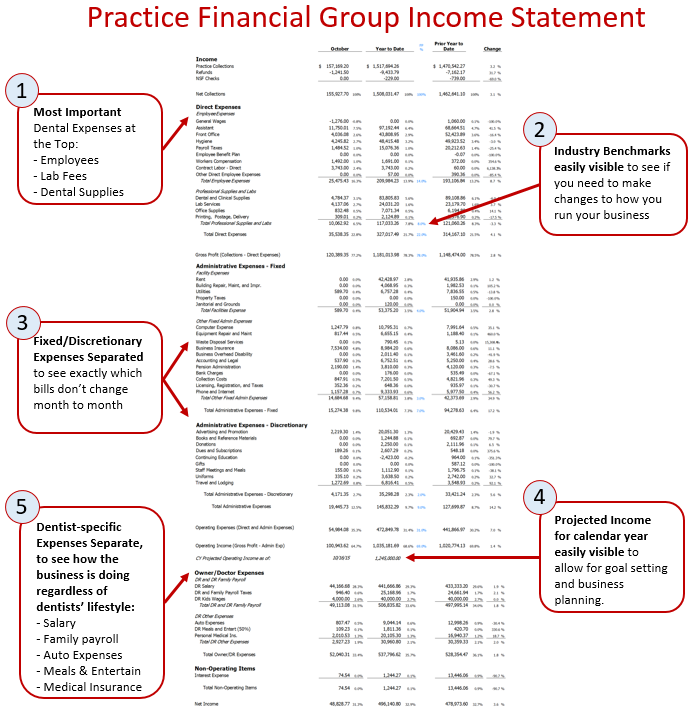

Check out the difference between a typical Practice Financial Group income statement and a typical statement from QuickBooks. You may have to click and zoom the image a bit.

Just like the quickest way to show someone who isn’t a dentist the difference between good orthodontics and bad orthodontics is to show them a side-by-side comparison of what good versus bad looks like, the quickest way to see good financial statements is to see them next to some bad ones.

Now, compare that to how a typical Income Statement looks out of QuickBooks (again, the point isn’t to be anti-QuickBooks. It’s just what most people use.)

Good financial statements have 5 key elements for dentists:

You should be looking for five key elements in your financial statements to get the most out of them for your dental practice?

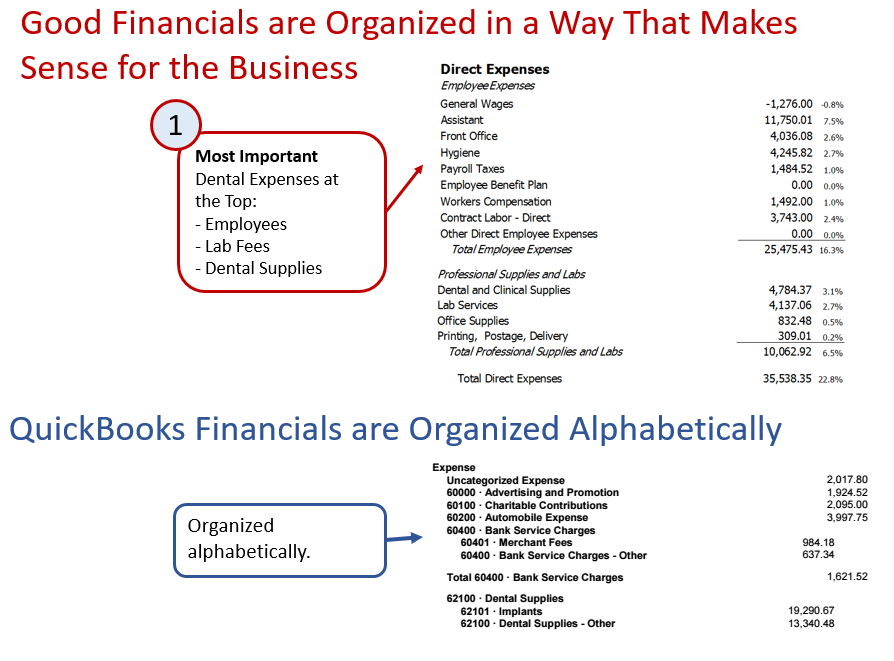

#1 – Organized Correctly

Your most important dental expenses should be one of the first things you see, and near the top of the page. When you look at the typical dentist’s QuickBooks financial statements, the expenses are grouped in alphabetical order. When the most important expenses in any dental office are Employee Costs, Lab Fees, Dental Supplies, and Office Expenses, why do you want to see anything else first?

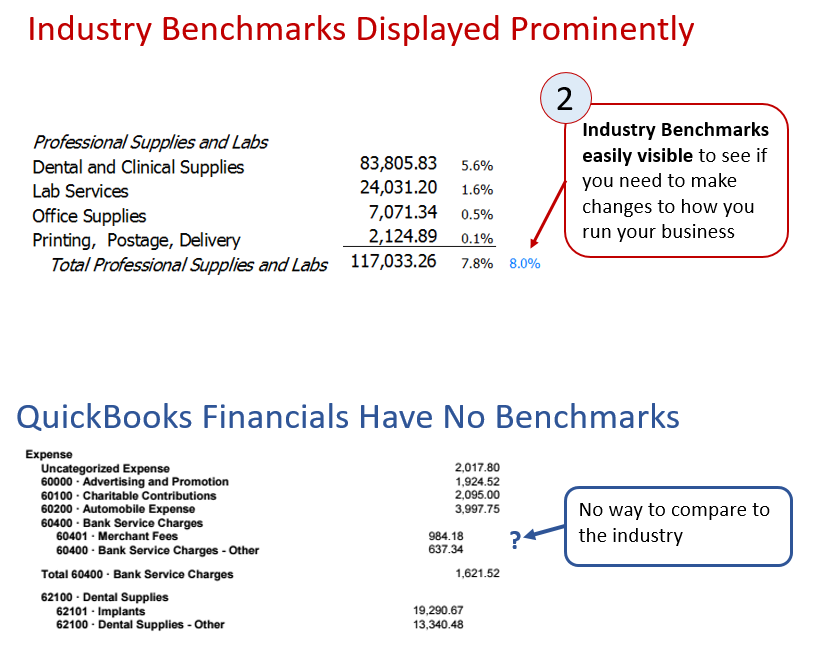

#2 – Dental Industry Benchmarks Should Be Included

You should see industry benchmarks for dental practices on the page, to have something to compare yourself to. You should be able to see how your practice compares to other dental practices. If you accountant isn’t adding that information into your financials, you are missing out on crucial information that is available and can help you run your practice better.

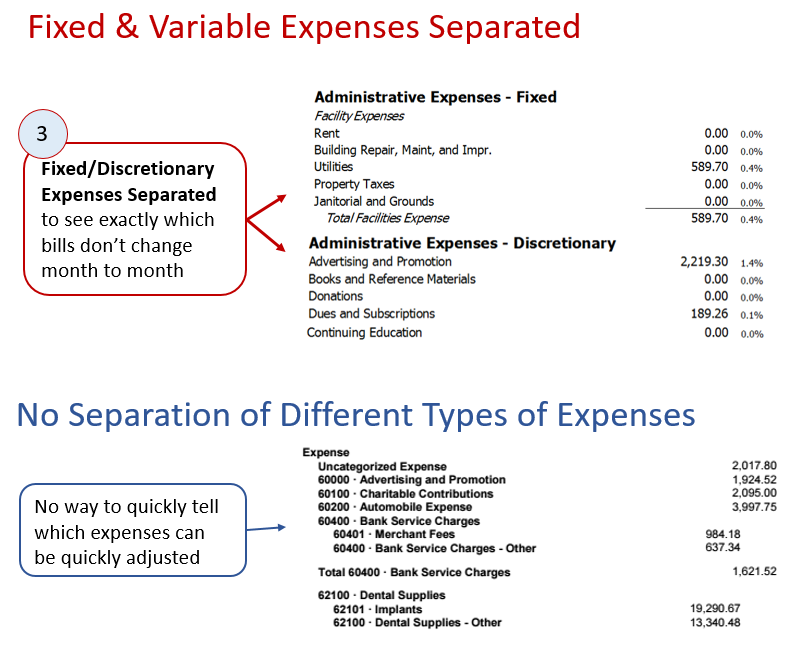

#3 – Fixed and Variable Expenses Separated

Your fixed and discretionary expenses should be separated. Some bills don’t change month-to-month. Your rent, utilities, landscaping, insurance, and other expenses are typically fairly steady year round. Other expenses, like advertising, continuing education, and travel (to name a few) can be highly variable. Wouldn’t you like to see clearly if you can afford to spend a little bit more this month on a continuing ed course, or if you should save up for next month? Good financials allow you to see the difference.

#4 – Should Include Year End Estimates

Your financial statements should estimate where you’ll end the year. Good financials will tell you how you are trending financially, and where you’re likely to finish the year in terms of profit. I like to know where operating income will end, so that I can plan my client’s personal taxes and payroll appropriately, but the point is that you see some kind of projection on where you’ll be.

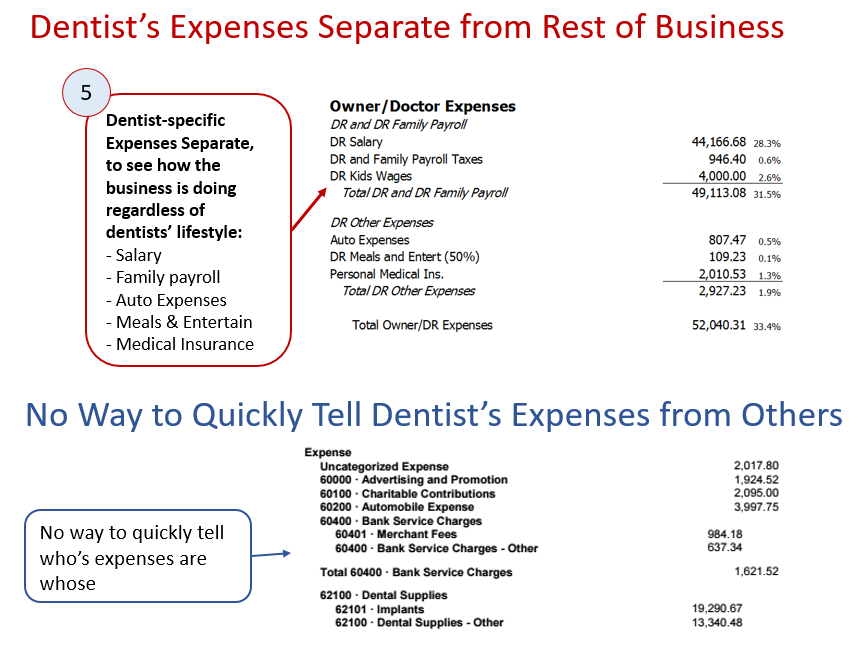

#5 – Dentist-specific Expenses Broken Out

Finally, the dentist-specific expenses should be broken out separately. Line items like your pay, your spouse/family pay, any perks like auto expenses and meals and entertainment can and should be separated from the other ongoing expenses of your practice. This allows you to be able to quickly tell how healthy the business is doing on its own. It can also tell you how much you take out of the business and allows others (banks, for example) to get a much cleaner view of the business.

If your financial statements have all five elements – great! You’ve got all the tools to know the score, and do something about it if needed.

If not, why are you still with your current accountant?