Apr 6, 2020

How to Apply for the PPP Loan

Written By: Nate Williams

Applying for the PPP Loan

Unlike the EIDL loan which had one lender (the SBA itself), each bank will have its own process for applying for the PPP Loan. We do believe, however, that applications will be similar enough that this information will be helpful in your effort to apply.

The first step is to calculate 2.5 times your average monthly payroll expenses. For PFG clients, we have calculated this number for you and have emailed this number directly to you. Applications also ask for the amount received under the EIDL loan. If you have not received any money from that program as of the time you apply for the PPP loan, put zero for this question. If you have received funds for the EIDL loan, input that number.

Banks will also request additional documentation, either at the time of the application or later. While the application process will vary from bank to bank, most banks will be asking for the following information:

- Payroll Reports

- Tax form W3

- Tax form 940 or 941 (for payroll)

- 1099 Income paid to Independent Contractors

- Financial Statements (Profit & Loss, Balance Sheet)

- Recent Tax Returns

Below you will find the guide for PFG clients to collect this information.

Locate payroll reports, W-3s, and Form 940/941

- 1. From https://practicefinancialgroup.com/, click “Login” in the upper-right corner, and select “Net Client Login”

- 2. Towards the upper right of the screen, select “myPay Solutions”

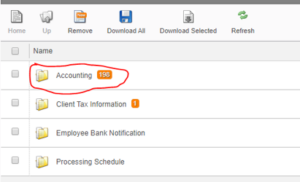

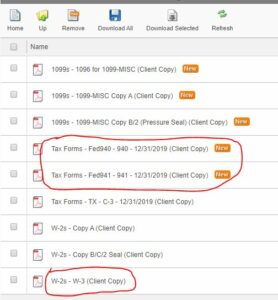

- 3. Select “Accounting” then “12/31/2019”

- 4. You will find your W3s and Tax Forms 940/941 in this folder

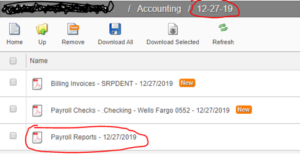

- 5. In some cases, you will also find the Payroll Report in this folder. In other cases, you will need to go back to the “Accounting” folder and select the last date in December, prior to 12/31/19. In this example, the Payroll report is in the “12/27/2019” folder:

Locate your 1099s, Financial Statements, and Tax Returns

- 1. From https://practicefinancialgroup.com/, click “Login” in the upper-right corner, and select “Net Client Login”

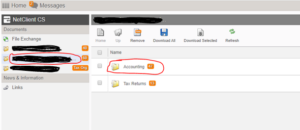

- 2. 1099s to Independent Contractors

- 3. Financial Statements:

- Once again on the left side of the screen, select the name of your Practice

- Select “Accounting” then “12-31-19”

- Your financial statements will be titled “Financial Statements 12/31/19”

- 4. Tax Returns (business – 1120S):

- Once again on the left side of the screen, select the name of your Practice

- Select “Tax Returns” then the applicable year to find your state and federal returns

- 5. Tax Returns (personal – 1040):

- Select your personal name (e.g. “Smith, John & Jane”)

- Select “Tax Returns” then the applicable year to find your state and federal returns

We hope this information is helpful. If you have questions during the application process, those may be best answered by your bank. However, if there is anything we can do to assist you in this process, please reach out to your PFG planning team.

If you are not a PFG client and have questions about applying, please email coronavirus@practicefinancialgroup.com and we’ll do our best to assist you.

-PFG Advisory Team