Dec 11, 2020

Cash Balance Plans 101

Written By: Nate Williams

Specific financial recommendations are like dental procedures – they are made when the circumstances make the recommendation appropriate. For the doctors with the right circumstances, we have been recommending Cash Balance plans for years to accelerate toward retirement and drastically cut taxes. The purpose of this post is to give an overview on what Cash Balance plans are and how they work.

Why tax-deferred savings?

Tax-deferred savings vehicles (e.g. IRA, 401(k), etc.) are important parts of a retirement plan. The specific vehicle (i.e., the 401(k) itself) is NOT an investment, it is a contractual agreement with the IRS1. You save money and promise not to use it until retirement; the IRS promises tax-preferential treatment for that money. In this way, the government can incentivize individuals to save for retirement.

Tax-deferred retirement accounts generally work like this:

- You put money into the plan and get a tax deduction*

- The money grows tax-deferred while it is in the plan (i.e., you do not pay taxes on investment gain)

- You pay taxes when you take the money out in retirement*

- *Alternatively, you can sometimes make “Roth” contributions, in which you do not get a tax deduction for contributions now, but you never pay taxes on the money again!

We have crunched these numbers with 100s of different scenarios; utilizing tax-deferred retirement plans is almost always the best way to save for retirement. The benefits include the following:

- Tax deduction now, while income is high

- Tax-deferred growth of your money (for example, if you get a 10% return, you keep the whole 10% in the account, working for you). Math proves that this is the biggest benefit of tax-deferred retirement accounts.

- Pay tax later as you use the money. Although we don’t know what your tax rate will be, we do know that you won’t have high earned income from working.

Defined Contribution vs. Defined Benefit

All qualified retirement plans fall into one of two categories: Defined Contribution (e.g. IRA, 401(k)) or Defined Benefit plans (e.g. Cash Balance plan). As the names imply, what the government is defining is either the contribution you can make, or the benefit you receive in the future. Let me explain:

Defined Contribution. With these plans, what is defined is the amount of contribution you can make each year into the plan. For example, in 2021 the IRS defines that you can contribute $6,000 into an IRA, and $58,000 into a 401(k) plan ($19,500 salary deferral + $38,500 employer contribution). Once you make the contribution, the amount in the account (the “benefit”) could drop to zero or grow to $10M or more, and the IRS would not care.

Defined Benefit. With these plans, the IRS is concerned with and defines how much you have in the account and how much you take out (the “benefit”). The contribution you make annually into the plan can vary widely, based on your age and how much you have previously contributed into the account. We have seen annual, tax-deductible contributions into a Defined Benefit plan range from $50,000 to $600,000.

Although there are no limits as to how much you can contribute into a defined benefit plan, there are certain limits on the tax deduction you can take on these contributions; these limits are determined by a number of case-specific circumstances such as your age, income, the amount previously contributed to the plan, and the amount of time the plan has been open. With rare exception (one we have not seen), when we have a client contribute to a plan, we expect to get a tax deduction for the contribution.

What is the maximum benefit?

Each year the IRS publishes the annual Defined Benefit Limits, which is the maximum amount a retiree can take as a benefit each year. For 2020 and 2021, this amount is $230,000 per year; this means that with a defined benefit plan, when you retire the plan can pay you up to $230,000 per year for life. An individual can also elect to take a lump-sum benefit distribution from the plan, which is then rolled into an IRA. The lump sum amount can vary slightly depending on a few variables; however, the amount is approximately $2,900,000 per individual under the current law. If you are married, with proper planning you could double this limit.

What is the end game of a Cash Balance plan?

Winding up a Cash Balance plan is like landing a plane – it takes careful planning and execution, all with the right timing. The timing of taking a distribution to an IRA, closing down the plan, and shutting down your business will vary based on a number of unique circumstances, all of which we’ll help you navigate to maximize the benefit. Make sure you have a pilot (trained financial planner) to help you land this plane!

In simple terms, in the end you will take a one-time distribution from the plan (the “benefit”) and roll this money into an IRA. You will then take distributions from your IRA in retirement for living expenses.

What are the right circumstances to setup a Cash Balance plan?

Earlier I mentioned that recommendations like this are comparable to dental procedures – whether you should do it or not depends on your circumstances. In general, the ideal circumstances to setup a cash balance plan include the following:

- High cash flow, including a lot of flexibility in what you are collecting and what you need to collect

- Lower debt (no student loans, perhaps no practice loan as well)

- Age – cash balance plans generally favor older doctors. 40 is the median age that we typically start a cash balance plan

What do the numbers look like for contributing to a Cash Balance plan?

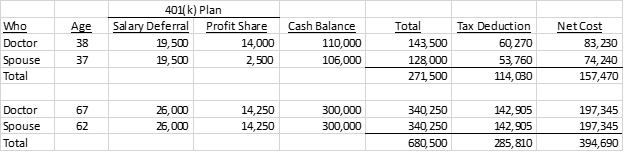

The table below shows a few sample scenarios for actual PFG clients (assume 42% marginal tax rate):

As you can see, the first household was able to contribute a total of $271,500 to these plans, with a tax savings of $114,030. In the second household, where the doctor is much older, they were able to contribute $680,500 with a tax savings of $285,810!

Will I cancel my existing 401(k) Plan?

Generally no. Most doctors add a Cash Balance in combination with their existing 401(k) plan; this is called a “401(k) Cash Balance Combo Plan.”

Will I have to contribute to my employees if I have a Cash Balance plan?

Yes. However, the employee contributions are typically small compared to the tax savings of the plan. Also, most of the time you can make an extra contribution into the 401(k) profit sharing plan in lieu of a cash balance contribution to satisfy the employee contribution requirement. All these numbers are projected and analyzed prior to you setting up the cash balance plan.

In conclusion, although the circumstances need to be right, adding a Cash Balance plan in combination with an existing 401(k) plan is an excellent way to both save taxes and, more importantly, accelerate progress toward retirement.

- Within the retirement vehicle, you can invest in almost anything. Think of the retirement vehicle like a dish in which you serve dinner; the investment is the actual food. For example, within your 401(k) plan you can usually invest in cash, stocks, bonds, gold, commodities, real estate, etc. These investment options, however, may be limited to what the plan sponsor (your business) has outlined for the specific plan. The important point to remember is that your 401(k) plan is NOT an investment, it is a vehicle (technically a contractual agreement with the IRS) to hold